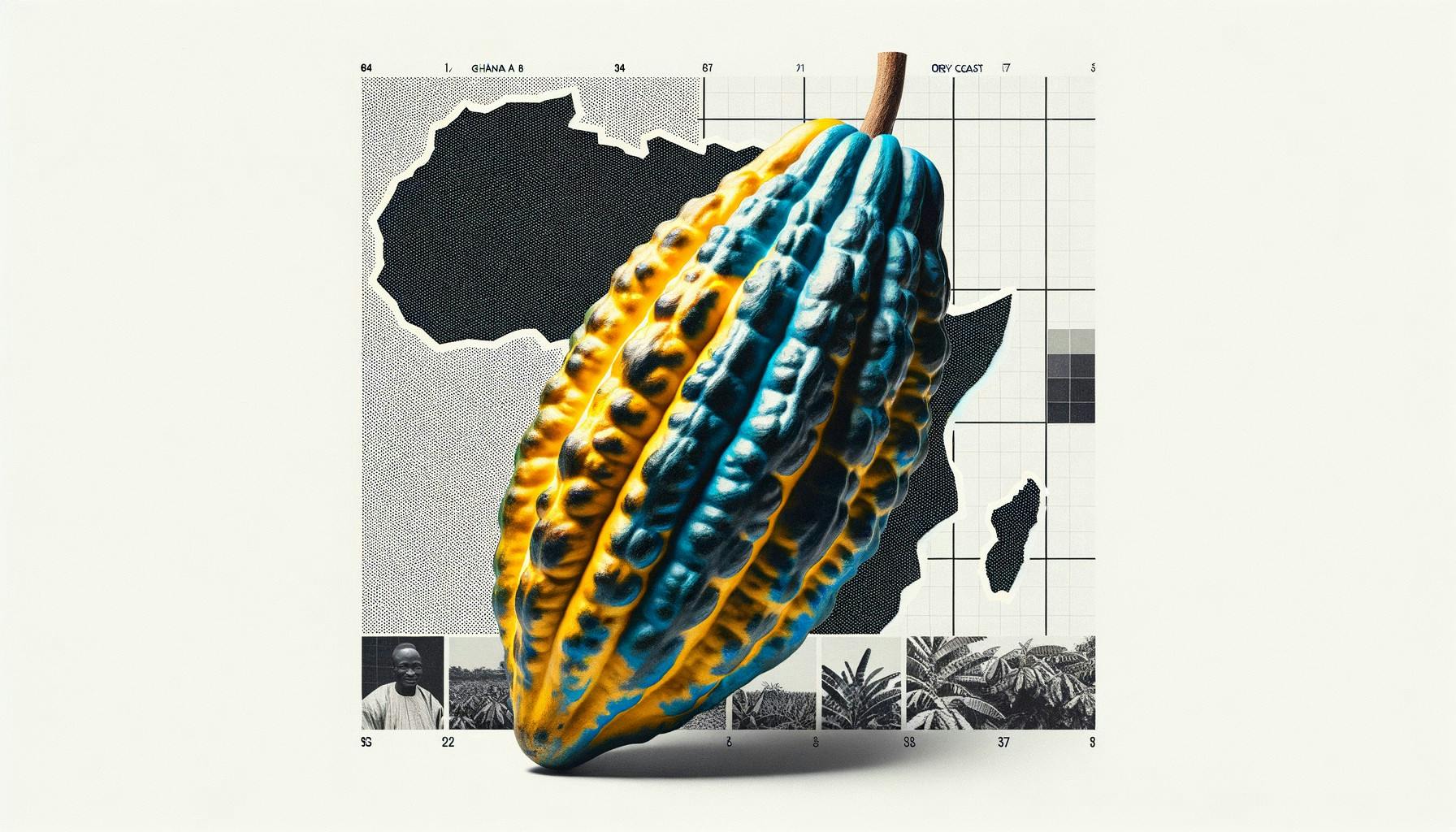

Cocoa Prices Hit Record Highs As Hedge Funds Retreat

What’s going on here?

Cocoa prices have skyrocketed to record highs due to supply chain disruptions in West Africa and hedge fund exits impacting the market.

What does this mean?

Cocoa futures prices surged in 2024 as hedge funds exited to dodge risks linked to volatile price shifts. West Africa, with Ghana and Ivory Coast at the helm, is the main source of global cocoa, dominated by industry players like Cargill and Olam. Futures markets are vital for commodity pricing, letting traders hedge against price fluctuations. However, hedge funds, which focus on speculating with complex algorithms, tend to avoid direct cocoa trades. Supply squeezes from poor harvests and management issues, like Ghana’s delayed shipments, further pushed prices up. This year’s early exit by hedge funds decreased market liquidity, intensified price volatility, and helped New York cocoa futures reach new heights.

Why should I care?

For markets: Cocoa’s bittersweet journey.

Hedge funds exiting the cocoa futures market reduced liquidity, increasing price instability. This impacts investors and producers seeking stable futures contracts and affects everything from chocolate production to broader market tactics.

The bigger picture: West Africa’s crucial role.

West Africa is pivotal in the global cocoa supply chain, but recent management and environmental issues present significant risks. These challenges highlight the need for sustainable practices and improved governance to stabilize supply, price trends, and ensure economic health for cocoa-dependent economies.

0 Comment